What is Folic acid ? Folic acid is a type of vitamin B that is normally found in foods such as dried beans, peas, lentils, oranges, whole-wheat products, liver, asparagus, beets, broccoli, brussels sprouts, and spinach. Folic acid helps your body produce and maintain new cells, and also helps prevent changes to DNA that may lead to serious diseases such as cancer.

Everyone needs folate, but it is especially important during pregnancy because of its role in preventing birth abnormalities. The Food and Nutrition Board recommend that adults get 400 micrograms (mcg) of folic acid per day, which should increase to 600 mcg during pregnancy and then reduce slightly to 500 mcg when breastfeeding.

Context to Folic Acid & Prenatal Vitamin growing demand

Although the vitamins and dietary supplements industry is steadily increasing, it tends to be more focused on the elderly population with more products targeted towards them and ensuring healthy aging. However, with China’s decreasing fertility rate, we are observing there a huge potential in the pediatric and prenatal supplements market.

Pediatric and prenatal supplements are becoming more and more popular among the pregnant women population, the reason being that it is used to optimize healthy body condition and a well-balanced mental development, from conception all the way through adolescence.

Market outperformance is expected to continue its growth, as the understanding of the importance of proper nutrition on healthy development improves, along with increasing disposable incomes of Chinese consumers and a shift in the parental demographic.

Globally, the target population for pediatric and prenatal supplements is declining proportionally relative to other demographics. Birth rates around the world have dropped steadily. Between 1983 and 2013, the number of births per 1,000 people declined by 30% from 28 to 19.

Despite these declines, the paediatric and prenatal supplements market is on the rise. Indeed since 2008, average retail value sales of paediatric and pregnancy multivitamins have increased annually by 5% or more per live birth. The increase in average spending per child is driven by several scientific, consumer and market trends that have more than offset the unfavourable population development.

In the study “Maternal nutrition at conception modulates DNA methylation of human metastable epialleles” published by Nature Communications in April 2014, a team of scientists found that nutrition can impact whether or not certain genes are activated in the early embryonic state development.

Another important factor influencing sales of pediatric and prenatal supplements is the general shift in the number of children per family. Typically, parents are moving away from large families and are having fewer children. Global fertility rates have decreased by 30% since 1983 to 3.0%, with Australasia, Eastern Europe, North America, and Western Europe being all below 2.0%.

While it may seem detrimental at first glance to pediatric and prenatal supplement sales, it may have actually opened up the market for parents who can now focus on ensuring the proper nutrition for fewer children. Parents are increasingly determined to optimize their children’s development, which they believe will translate to future potential, among the fewer children that they are having.

On the same topic : China Medical Tourism: How to attract patient looking for IVF and/or Surrogacy ?

Additionally, improving economic conditions and growing disposable incomes are improving the accessibility of pediatric and prenatal supplements. Controlling inflation, annual disposable income worldwide grew 3% between 2009 and 2013. Many parents prioritize the needs of their children, especially regarding health and wellbeing, a portion of the increasing disposable income is being used on pediatric or prenatal vitamins as seen through increased retail value sales per child.

The increasing demand for supplements targeted towards children is generally consistent worldwide. All regions, except Latin America, have experienced solid gains in retail value sales of both pediatric and pregnancy vitamins.

Market Evolution

All signs point towards a sustained growth for pediatric and prenatal supplements as scientific improvements highlight the importance of nutrition, parents continue to prioritize the healthy development of their children and as the economic environment allows them to.

As with adult VDS, there is controversy over the necessity of pediatric supplements and their actual influence on health. However, parents will continue to spend on what they perceive will benefit their children, which translates to huge market potential. Global per household spend on pediatric supplements is expected to rise by 17%.

Crossborder E-commerce, Health and Vitamins in China

As the world’s most populous country, China is one of the biggest markets on the planet for almost anything. This is certainly the case for health supplements, which boast a massive market in China. The latest figures from 2018 put the industry as being worth some 22.78 billion USD.

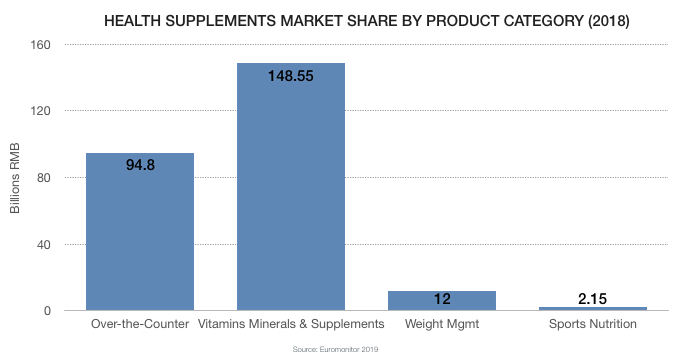

It is estimated that by 2023 this figure could rise to 40 billion USD, following a 2019-2023 compound annual growth rate of 14%. Vitamins, Minerals, & Supplements (VMS) account for more than 90% of the entire health product industry.

This segment increased 9.2% from 2017 to 2018, to reach a total market size of 148.55 billion RMB. However, despite the rich variety in product types within this segment, as a whole, it is highly homogenized. Many products are functionally identical or equivalent to competitors’ offerings.

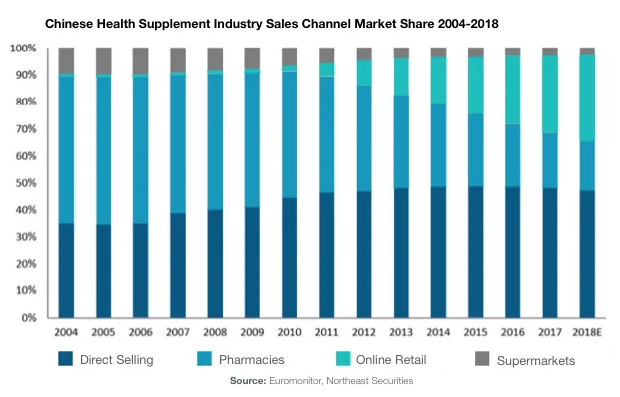

Online retail represents the major sales channel. With unparalleled convenience and the ability to offer far wider selections of available goods than any physical retail location.

This is especially true for the Chinese market, and has become a vital channel for health supplements in the country. This is particularly true for overseas sellers. Cross-border channels now enables sales to China without any physical or legal presence there.

When compared to the total market size, the online market still represents only a minority of sales, with offline sales still accounting for more than 50%. However, strong growth over most of the past six years has seen this share grow considerably, and while 2018 saw smaller growth than the market as a whole, with growing integration between online and offline lifestyles in China, it is a strong possibility that online sales with overtaking offline within the next decade. Either way, online selling has become impossible to ignore.

China’s Vitamin Market is Competitive

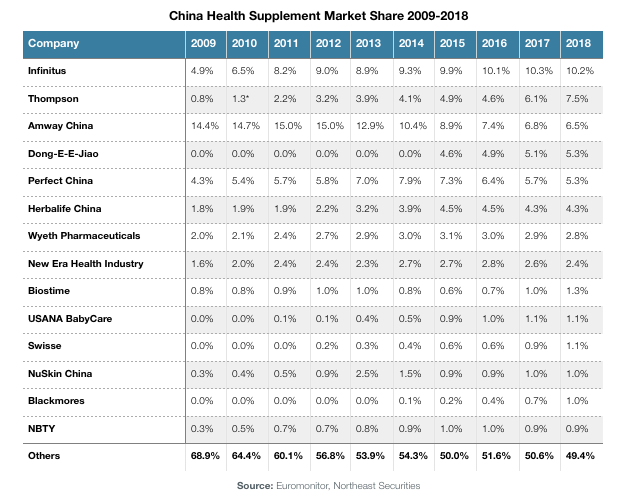

Over the past decade, the number of companies in the Chinese health care products market has more than doubled from just 6 in 2009 to 13 in 2018. Currently, Infinitus holds the most of any company operating in the country, at 10.2% of the market share, with Thompson rising to 7.5% in 2018, and Amway China shrinking to just 6.5% after having peaked at 15% in 2012.

There’s a lot of space for new market entrants. Especially given the degree of change we can see in the market shares of the leading companies over the last decade. For now, no brand is so entrenched that it is immune to competition from rising stars.

Asia prenatal market size

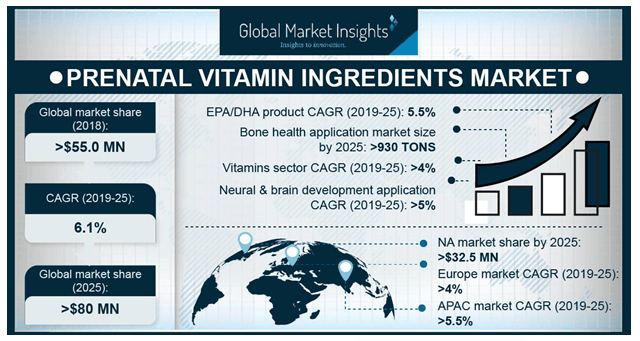

Throughout the years, concerns among pregnant women have been growing in regards to the lack of vital vitamins that occurs during pregnancy, this has resulted in an increase in the prenatal vitamin market. These vitamins are very much appreciated because they manage to reduce the risk of diseases that may appear while the pregnancy is ongoing. They do so by providing enough nutrients and enhance and protect the body’s metabolism.

Prenatal vitamins are gaining more and more popularity amongst Chinese women, on account of their nutrient-rich nature and ability to support a healthy and immune system. The global Vitamin A market size from the food application segment was valued to be over USD 180 million (2017) indicates that there is a high potential for vitamins and supplements.

According to WHO (World Health Organization), in 2017 more than 9.5 million pregnant women worldwide suffer from night blindness which is projected to have positive impact on Vitamin A ingredients demand. During pregnancy, nutritional need increases significantly to meet the demands of the pregnant woman and the growing baby.

These ingredients promote fetal healthy growth, prevent anemia and ensure that babies are born at healthy birth weight, it also contributes to the health and well-being of the mother. They fulfill the body’s essential requirements during pregnancy.

They contain Iron which is essential to maintaining the required count of blood cells. However although Iron supports the good functioning of the body, it is imortant to keep in mind that a high consumption can lead to Iron toxicity in the body, such a high level of Iron can potentially act corrosive to the tissues in the gastro-intestinal such as the intestine and the stomach that can lead to serious poisoning, this aspect might negatively impact the market growth.

Chinese consumers preferences

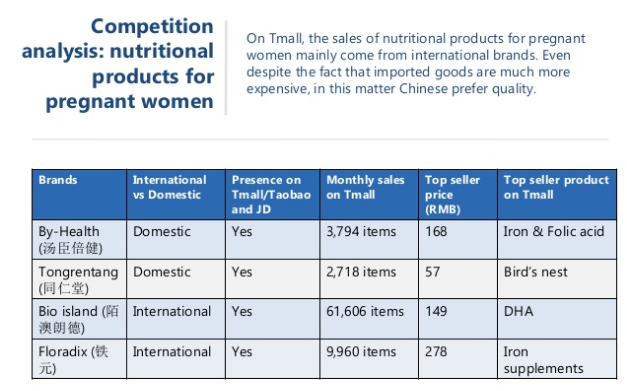

In China, consumers prefer buying their supplements from international brands, even if the price is much higher than national brands which tend to be less expensive but chinese consumers would rather pay more and be certain of the quality and origin of the goods they are buying.

Industry Player : Blackmores

Blackmores is an australian health-care brand, they sell a wide variety of produce and items like vitamins ad supplements etc… Blackmores mainly sells on online platforms, and as such it is considered by many chinese consumers as their favorite brand to buy their products from. Moreover most of they keyword search related to Blackmores are related to pregnancy supplements and health items.

Perinatal supplements risks

In China, the rate of perinatal mortality used to be twice as high as in the United States. The causes of perinatal mortality include :

- Low birth weight

- Preterm delivery

- Anemia (low hemoglobin)

Supplements of iron, folic acid, and other vitamins and minerals can prevent anemia among pregnant women, but the effects of these supplements on other maternal and infant health outcomes are unclear.

Since the early 1990’s, the People’s Republic of China has recommended that newly married women, and those who plan pregnancy, should take 400 gr of folic acid every day all the way through the first trimester of pregnancy.

Although WHO recommends that pregnant women take iron and folic acid supplements, there is currently no national recommendation that pregnant women in China take iron or other vitamin or mineral supplements (other than folic acid).

Build your e-reputation in China to sell Folic Acid

In China, the digital scene is totally on the opposite side of the spectrum from the West. As you may already know in China, Google will not be efficient, instead you will have to use Baidu.

Almost every western application has its chinese equivalent, there is no WhatsApp but chinese consumers use instead WeChat, no Facebook or Instagram but rather Weibo and Little Red Book. For this reason, it is very important to work on building a good online reputation. Without a good brand image and reputation and without being well known it is very unlikely that you succeed on making your spot on the chinese market.

SEO , to reply all question of People

When Chinese consumers research online info about Folic Acid or maternity healthcare products, you have to make sure that they encounter your website. So you have to make it ranks in the first positions; bear in mind that, usually, a user chooses the first five presented websites.

A good SEO campaign can help your website to gain visibility in a successful way on the internet. For a good SEO strategy, it is necessary to identify the sector and the target, choosing the most effective keywords is also important, and last but not least, it is very to know the competition.

- Zhihu is also the best Q&A platform to answer questions of public

- Baidu, the best search engine in China

WeChat and Weibo

Create official accounts on WeChat and Weibo in order to communicate and engage with customers. Official accounts will give you authority and credibility in Chinese consumers’ eyes.

- WeChat is a must-have when doing business in China. It allows brands to send notifications to their followers and to engaged with them.

- Weibo is similar to our Twitter. Post good content for your followers and they will be able to share it easily. Your post will get only a second of attention so you have to make it count. Weibo is a great tool for being commercial. Weibo users are looking for discounts and commercial offers. Collaborate with KOLS (Chinese influencers), on Weibo to promote and introduce your products.

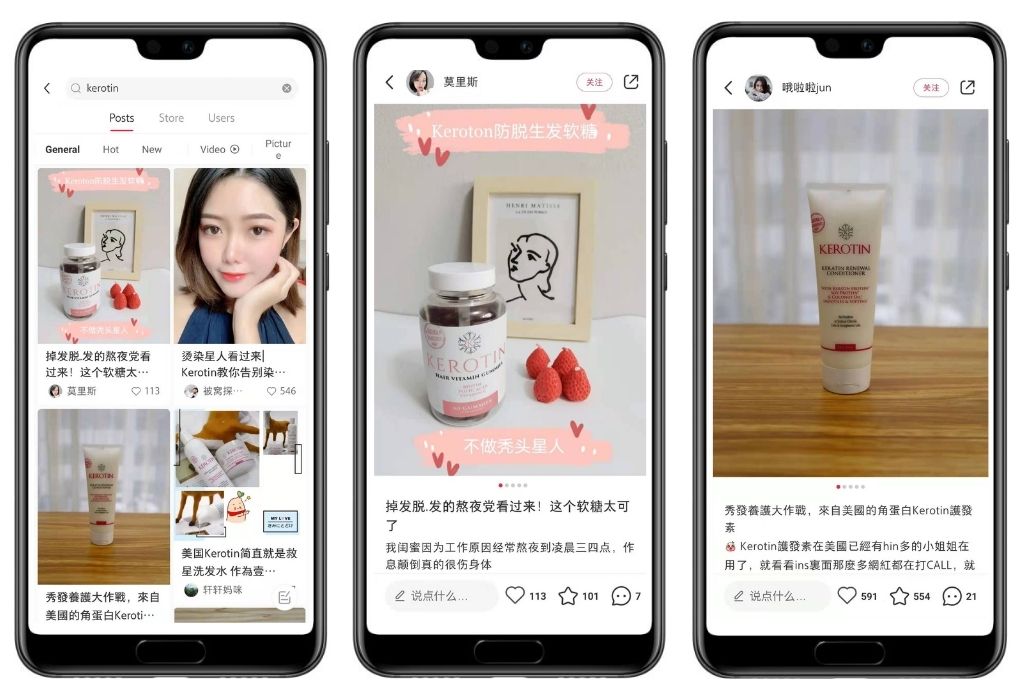

- RED like instagram, it s a great social media for female so to target mother. It is a lifetyle, story based social media

Douyin Crossborder ecommerce

Douyin, the Chinese version of TikTok, is a powerful platform for e-commerce, particularly effective for engaging with a large and diverse audience. Its immersive video format and integration with e-commerce functions make it an ideal venue for brands to showcase and sell products, including health supplements and maternity care products. Here are seven key points for brands looking to leverage Douyin:

- Visual Storytelling: Capture attention with engaging and visually appealing stories about the benefits of your products. Do not sell… tell a story. 🙂

- Influencer Partnerships: Collaborate with Douyin influencers who can authentically promote your health and maternity products to their followers.

- Live Demonstrations: Brands should do live streaming features to demonstrate product use and interact directly with potential customers in China.

- Flash Sales: Create urgency and boost sales through time-limited offers and discounts during live streams.

- Educational Content: Provide valuable information about health and maternity care, positioning your brand as a trustworthy source.

- Interactive Features: Engage users with polls, quizzes, and Q&A sessions to foster interaction and gather feedback.

- User-Generated Content via KOL: Encourage customers to share their own experiences and results, boosting credibility and trust.

By focusing on these strategies, brands can effectively use Douyin not just to sell, but to create a community around their products, enhancing brand loyalty and consumer trust.

Tmall and JD in 2024… Good question

Tmall and JD.com are two of the largest e-commerce platforms in China, offering unique opportunities for brands to reach millions of consumers, these platforms are losing market share to Douyin in 2024. These platforms are especially effective for selling specialized products such as health supplements and maternity care items, due to their sophisticated logistics, trustworthiness, and extensive customer bases. Here are seven concise strategies for brands aiming to excel on Tmall and JD.com:

- Brand Storefront: Establish a customized, brand-specific storefront to showcase your product lines and enhance brand identity.

- Product Certification: Highlight certifications and approvals to reassure customers about the safety and quality of your health and maternity products.

- Detailed Descriptions: Provide comprehensive, easy-to-understand product descriptions and benefits to educate potential buyers.

- Customer Reviews: Encourage satisfied customers to leave positive reviews, which play a critical role in consumer decision-making.

- Cross-Marketing: Utilize bundle deals and cross-promotions with related products to increase exposure and sales.

- Seasonal Campaigns: Leverage holidays and special events for themed marketing campaigns that resonate with target customers.

- Customer Service Excellence: Offer exceptional customer service, including detailed product guidance and post-purchase support, to build trust and loyalty.

Foriegn Brands can leverage the features of Tmall and JD.com to effectively market and sell health supplements and maternity care products.

Do you want to sell your supplements in China? Contact GMA.

We are a team of native digital experts based in Shanghai, we have a deep insight into this fascinating market and stay ahead of the curve. If you have a serious project for the Chinese market you can consider news app ads, contact us for a meeting with one of our consultants.

We also work extensively in the following area’s;

- Baidu SEO/PPC

- WeChat Development

- Weibo Marketing

- Chinese Content

- PR/Media Exposure

- Targeted Forums & Blogs (niche markets)

- Ecommerce Douyin, Tmall, JD

- Lead Generation Services on Multiple Platforms