In over a decade as an E-Commerce Agency, never have we seen a year on year growth as the one the Chinese dietary supplements market for several years already.

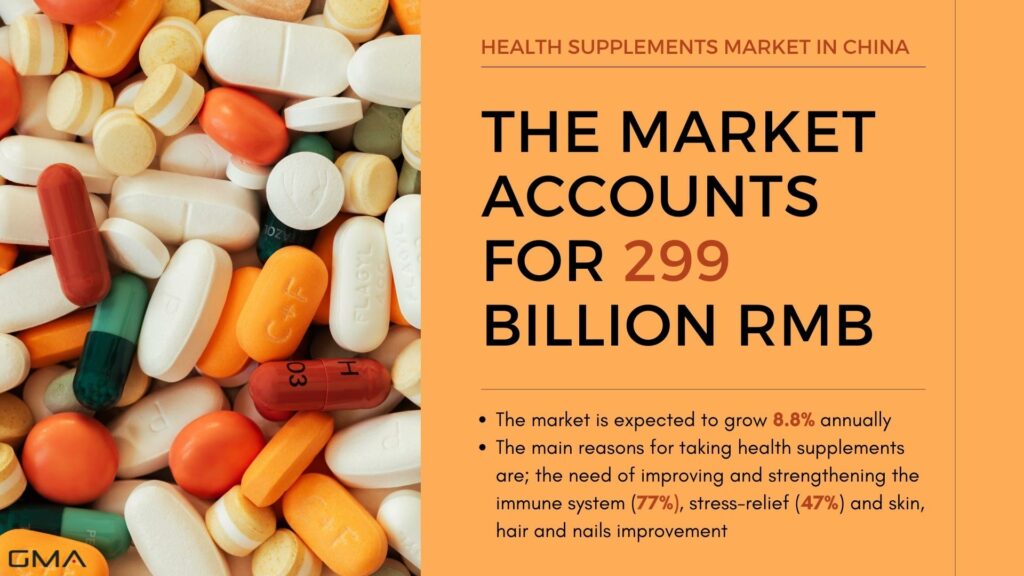

In 2023, China’s health supplement market reached an impressive size of approximately US$ 19.22 billion. Experts and analysts predict further growth of this market segment, projecting a market size of US$ 27.03 billion by the end of 2028.

To successfully enter the Chinese market and sell vitamins and health supplements, it’s crucial to be well-prepared. Here are some essential tips to help you navigate this unique market and effectively sell your products.

Contents

- 1 Quick Summary

- 2 Characteristics and Trends in the Chinese Vitamin Market

- 3 Key Regions to Sell Your Health Supplements in the Chinese Market

- 4 How to Market Your Vitamin and Dietary Supplement in China?

- 5 How to Sell Your Vitamins and Health Supplements in China?

- 5.1 E-Commerce in China

- 5.2 Douyin, the game changer in Health supplement

- 5.3 Douyin Key Data and Growth Trends 2024

- 5.4 The Importance of Having a Website for the Health Supplements Sales in China

- 5.5 Baidu SEO for Vitamins and Dietary Supplements in China

- 5.6 How to Promote Dietary Supplements on Chinese Social Networks?

- 6 Case Study – Vitamin Australia Brand ‘Blackmores’ Achieve Huge Success in China

- 7 Contact us to sell your health supplements products in China

Quick Summary

- Market Growth: China’s health supplement market reached approximately US$ 15.88 billion in 2021, with a projected growth to US$ 27.03 billion by 2028, indicating a CAGR of 7.72% from 2022 to 2028.

- Consumer Demographics: The primary target market includes consumers under 30 years old, who show a strong interest in vitamins and health supplements. There’s also a growing market among Chinese children, driven by parental concerns for nutrition.

- Health Trends: Post-COVID-19, about 44% of Chinese consumers reported an increased intake of dietary supplements, mainly to enhance immune systems.

- Economic Influence: Rising income and purchasing power in China, especially in urban areas, have led to increased spending on health supplements.

- Cultural Factors: There is a significant emphasis on physical appearance and health, aligning with Chinese beauty standards and lifestyle choices.

- Market Challenges: Foreign brands need to navigate local regulations, including labeling requirements and product registration, which can be complex and time-consuming.

- E-Commerce Dominance: Platforms like Tmall, JD.com, and Taobao are crucial for market penetration due to their vast user base and the convenience they offer.

- Digital Marketing Strategy: Establishing a strong online presence and brand reputation on Chinese social media platforms and websites is essential for success.

- Consumer Preferences: Chinese consumers value brand recognition, quality, and peer recommendations. Transparency in ingredient communication and scientific evidence backing the products are key to gaining consumer trust.

- Local Brand Perception: Due to past scandals with domestic brands, there is a skepticism towards local brands, giving foreign brands an edge in terms of perceived quality.

- SEO and Online Visibility: Having a Mandarin Chinese website hosted in China is crucial for visibility on Baidu, the leading Chinese search engine.

- Key Opinion Leaders (KOLs): Collaborating with KOLs can significantly influence consumer perception and brand popularity in the health sector.

Characteristics and Trends in the Chinese Vitamin Market

Before entering the market, you have to know that China has some characteristics that make it easier for brands to sell their vitamins and health supplements:

China’s Economic Growth

China’s population has seen an increase in income and purchasing power. Many people were able to be part of the Chinese middle class and benefit from the influence of Western culture, especially in the first-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen, but also in emerging cities such as Hangzhou, Chongqing, Chengdu, etc.

Healthy Lifestyle

More and more consumers are striving to live a better and longer life and improve their appearances to fit more with Chinese beauty standards (especially true with Chinese women) and also physical health.

According to a survey conducted by Rakuten Insight in March 2022, around 77% of respondents living in Mainland China said they took vitamin and dietary supplements to improve and strengthen their immune systems. Only 11% of them took supplements for weight loss, an area where reducing food consumption is more achievable than buying vitamins.

Targeting a New Age Group: Children’s Market Expansion

The consumption of vitamins and dietary supplements has also increased among Chinese children whose parents worry about low vitamin levels and quality of nutrition through a more diverse diet and consumption of dietary supplements.

Aging Society

Traditionally, this group has embraced specific group foods and adhered to traditional Chinese medicine practices as preventive measures against diseases, with a focus on physical appearance, particularly among women. However, there is a growing trend among the elderly to consume vitamins for immune system enhancement, representing an untapped niche.

GNC has introduced high-quality products to meet the needs of the elderly. These products aid in improving sleep quality, assisting with weight loss, protecting bones and joints, and enhancing immunity.

Covid-19 and Vitamin

The same survey by Rakuten revealed that approximately 44% of participants from mainland China who consumed dietary supplements reported an increase in their supplement intake following the COVID-19 outbreak.

Local Brands Scandals in China

Following several issues from domestic brands, Chinese peoples are more skeptical of local brands and thus rely on foreign brands when it comes to health supplements, cosmetics, food, and skincare products. For instance, Australian brands have a high reputation within China’s People’s Republic.

Presence of E-Commerce Platforms and Online Stores

As a result of China’s rapid digitalization, e-commerce platforms were able to grasp more than 900 million users. The key leaders of e-commerce are of course Tmall, JD.com, and Taobao, but other players were also able to stand out in the e-commerce industry such as Xiaohongshu, Pinduoduo, Kaola, etc.

On top of the wide range of products available on these e-commerce platforms, people are also benefiting from quick delivery within the same, which makes it easier and more attractive for foreign brands to sell their health supplements on online sales channels.

Key Regions to Sell Your Health Supplements in the Chinese Market

Even though it might seem surprising, the biggest health foods end-product importer in China was the province of Guangdong (25,8% of all the health food imports, which amounted to US$773 million), while Tianjian was the fastest growing in terms of imports.

Shanghai and Zhejiang took respectively the 3rd and 2nd spot, importing health supplements worth US$629 million and US$739 million.

However, when it comes to the health supplements market in China, don’t focus only on these provinces, because thanks to e-commerce platforms, you don’t need to worry about selling your products and delivering them to consumers all across China.

How to Market Your Vitamin and Dietary Supplement in China?

Comply with Chinese Regulations

As in any country around the world, you will need to comply with the country’s regulations. As a matter of fact, if you want to sell your vitamin and health supplements in China, you will need to complete and apply for labeling requirements. Don’t forget that you will need to translate everything into Chinese and send it to the seller’s platforms or warehouse before shipment.

Fulfill Chinese Consumers’ Demands

- Brand awareness holds paramount importance in China when it comes to health supplements and vitamins. Chinese customers prioritize brand recognition while making purchasing decisions.

- Establishing a strong online presence on Chinese websites and social media platforms is crucial for success in the Chinese market.

- Clear and easily understandable product descriptions play a significant role in capturing the attention of Chinese consumers, who focus on the functionality and effects of the products.

- Emphasizing the quality of the product is essential, as Chinese consumers often exhibit greater confidence in purchasing foreign products over domestic ones.

- Word-of-mouth and feedback from other consumers, as well as social media, heavily influence the attractiveness of a product among Chinese consumers.

- Price comparison with similar brands is a key factor in the purchasing decision-making process for Chinese customers. Conduct thorough research on competitors and adjust the price range accordingly before exporting products to China.

How to Sell Your Vitamins and Health Supplements in China?

Selling products in China is as difficult as it might seem. However, it is important to know the Chinese market beforehand, as well as the best methods to sell your vitamins and health supplements in China.

E-Commerce in China

Product registration and licensing for Health Sector Products is an extremely lengthy process, even if applications are successfully managed, it can take up to 3 years to complete the process and there is no guarantee of approval. In fact, China has a strict system and regulations when it comes to health-related products.

If you cannot afford e-commerce platforms, or if you don’t want to, you can sell straight away without a license, but you will need approval from the relevant cross-border platform. With China’s huge online population of over 938 million netizens and 800 million e-shoppers, e-commerce platforms are in general the best way to sell products in China.

Tmall: A Powerful E-Commerce Platform for Health Supplements Brands in China

Founded in 2008 under the famous Alibaba group, Tmall (天猫), is a subsidiary of the e-commerce website Taobao (淘宝网). Its target market is primarily B2C (Business-To-Consumer). Tmall’s concept is ambitious and wise as it allows both local and international companies to sell their different categories of products through the platform in mainland China, Hong Kong, Macau, and Taiwan. Tmall stands out from its competitors thanks to its strict standards in terms of quality and renown.

With Tmall being one of the largest and most reputable cross-border e-commerce platforms in China, it benefits from an authentic reputation among Chinese consumers.

A Tmall.com storefront is essential to the China retail strategy of leading global businesses and the most effective avenue for market penetration.

There are two ways to join Tmall‘s platform:

- Companies with China in-country business operations can apply to Tmall.com.

- Companies with overseas licenses are eligible for the cross-border e-commerce platform Tmall Global.

As an open platform marketplace, Tmall.com provides the infrastructure to host your storefront and unfiltered access to a wide audience of consumers. Operating a Tmall.com storefront is much like operating your own B2C website, offering autonomy from design to operations to fulfillment and logistics.

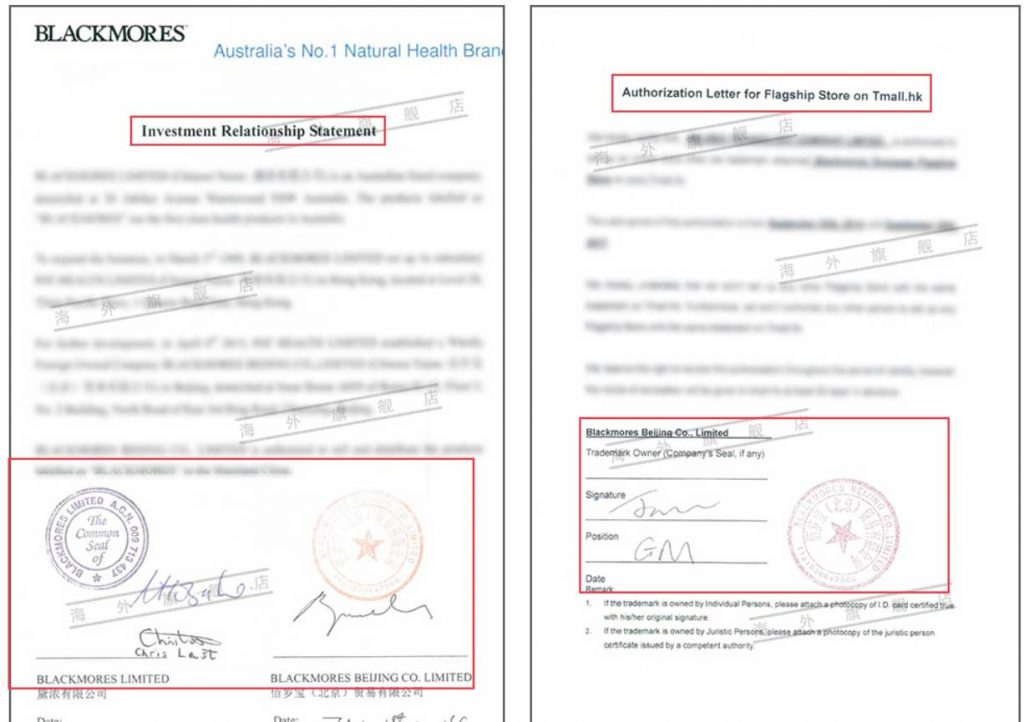

If you want to sell on Tmall, you will need Official Authorization from the brand to sell on Tmall.cn & Tmall.hk. This Authenticity is very important in China because the domestic market was often associated with counterfeits and poor-quality local goods.

The buyers on Tmall need to verify that this store & product are genuine, this is why selling on this platform is more effective, with higher conversion rates.

Sell Vitamins on JD.com

Founded in 1998 by Liu Qiangdong in Beijing, JD (which stands for Jingdong 京东) was at the beginning only a magneto-optical store, which diversified over the years with electronics, computers, mobile phones, etc. In 2004, it opened its online retail platform and quickly became one of the two massive B2C online retailers in China with its competitor, the Alibaba-run Tmall. Now, JD.com is partly owned by the giant Tencent, which has 20% of its stake. As of 2021, JD.com has over 569.7 million active customers.

In 2022, the total net sales revenues of the online shopping company JD.com amounted to 1,046.2 billion yuan ($151.7 billion). JD.com runs one of the biggest online marketplaces in China, with other platforms being Tmall, Pinduoduo, and Suning. Thus, if you want to sell your health supplements in China, you can apply for the e-commerce platform JD.com and become a seller.

Taobao as an Alternative Platform for Selling Vitamins

Launched in 2003 by e-commerce giant Alibaba, Taobao (淘宝网) is one of the most popular online shopping platforms, specializing in both B2C and C2C transactions

Contrary to Tmall and JD.com, it is easier to be on Taobao as regulations are not as strict. However, be careful to read all the clauses about selling health supplements in China before applying. Taobao does not have a cross-border e-commerce option.

Douyin, the game changer in Health supplement

Douyin (chinese tiktok) has become a pivotal app for marketing health supplements in China, utilizing its vast user base (800millions active user) and powerful engagement tools to influence consumer behavior and drive sales for health brands

Douyin Key Data and Growth Trends 2024

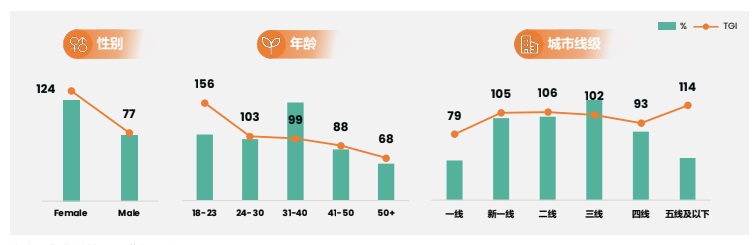

- User Demographics:

- Douyin’s health supplement audience primarily consists of younger demographics, with a significant presence of women aged 18-35 who are particularly interested in wellness and health products.

- There is a notable interest from users in first-tier and new first-tier cities, who tend to have higher disposable incomes and a greater willingness to spend on health and wellness products.

- Market Penetration and Engagement:

- Health supplements are one of the top categories for e-commerce on Douyin, benefiting from high viewer engagement rates. Products often featured include vitamins, proteins, and traditional Chinese herbal supplements.

- Live streaming sessions on Douyin have proven effective for launching new supplements, with influencers and KOLs (Key Opinion Leaders) demonstrating product uses and benefits in real-time, driving immediate consumer interaction and sales.

- Sales and Marketing Trends:

- Influencer partnerships are crucial on Douyin. Brands frequently collaborate with health and fitness influencers to reach their target audience more authentically.

- Douyin’s algorithm favors content that generates high user engagement, which is beneficial for health supplement brands that employ creative and informative content strategies.

- Consumer Behavior Insights:

- Users on Douyin are highly responsive to trends and innovations in health supplements, such as organic and natural ingredients, which align with the growing health consciousness among Chinese consumers.

- There is a growing interest in personalized nutrition, leading to increased popularity of tailored supplement solutions, which are often promoted through interactive Douyin content.

- Growth Projections:

- The health supplement market on Douyin is expected to continue growing as more users turn to social media for health-related information and product recommendations.

- As of recent reports, the health supplement industry in China is projected to grow significantly. Platforms like Douyin are critical in this expansion, providing a direct-to-consumer marketing channel that can adapt quickly to changing consumer preferences.

On Douyin, who buy?

Imported nutritional supplement categories that target female buyers, such as skin rejuvenation and brightening, and women’s health care, show significant advantages in advertising deployment and GMV scale, with a high commercial input-output ratio. In the post-pandemic era, products that support liver health, cardiovascular health, and help ease breathing continue to grow rapidly.

Products focused on sports slimming and complex nutrition maintain steady growth, with potential for further GMV increase through high repurchase rates and expanding target demographics. These categories have established a good reputation among users, attracting more loyal customers and increasing sales by continuously expanding the target user base.

Categories like hair care and eye care in imported nutritional supplements still have significant room for growth but require increased commercial traffic investment to break through current advertising expenditures and GMV levels. These categories may need more promotion and advertising to enhance visibility, attracting more user interest and purchasing intent

Best sellers on health supplement in China 2024

The Importance of Having a Website for the Health Supplements Sales in China

If you want potential clients to discover your brand, you need to have a website in Chinese Mandarin, hosted in China (for SEO reasons). Take into account that Baidu (the leading search engine in China), will not rank websites hosted in other countries or websites in other languages than Mandarin.

This is why it is considered mandatory to have a website tailored to China’s internet in order to attract consumers. Moreover, it is even more important as Chinese adult consumers will be looking for the specificities and explanations about your products. Don’t forget to write a detailed description of your health supplements and your brand.

This is why it is considered mandatory to have a website tailored to China’s internet in order to attract consumers. Moreover, it is even more important as Chinese adult consumers will be looking for the specificities and explanations about your products. Don’t forget to write a detailed description of your health supplements and your brand.

Baidu SEO for Vitamins and Dietary Supplements in China

Baidu’s biggest attribute and main selling feature are that they only index simplified Chinese characters. In fact, Baidu prefers 100% Chinese-written websites and has difficulty distinguishing several languages. Besides, to improve its trust rank, it is recommended to have a “.cn” website.

As 75% of the research in China are on Baidu, you need to have a good ranking on Baidu to be visible and sell your vitamins and health supplements to Chinese adult consumers.

How to Promote Dietary Supplements on Chinese Social Networks?

The brand image holds great importance, and careful consideration should be given to the product name selection. The name should align with Chinese cultural beliefs and incorporate elements related to “health,” “well-being,” and “form.” Establishing a positive e-reputation is crucial. Western supplement brands leveraging social networks (WeChat, Weibo, Douyin, etc.) should prioritize certain aspects of their marketing strategies:

- Transparency in Ingredient Communication: Chinese consumers desire clarity regarding the ingredients used in health products, so transparent communication is highly recommended.

- Scientific Foundation: In China, with a strong appreciation for science, it is essential to ground the benefits of health products in scientific evidence.

- Peer Recommendations: Chinese consumers heavily rely on peer recommendations when making purchase decisions, seeking assurance of a product’s effectiveness.

- Emphasis on Quality: Highlighting the use of high-quality raw materials and formulas helps establish trust and emphasize product quality.

- Collaboration with Key Opinion Leaders (KOLs): Chinese consumers place significant trust in KOLs, particularly in the health sector. Collaborating with influential KOLs can positively impact brand perception.

For instance, By-health, a leading Chinese brand, adopts a strategy of focusing on key products, educating consumers, and conducting targeted marketing activities within a specific category.

Similarly, GNC has introduced new dietary supplement products, placing emphasis on their utilization of high-quality raw materials and formulas.

Case Study – Vitamin Australia Brand ‘Blackmores’ Achieve Huge Success in China

In 2022, the Australian vitamins and health product supplier ‘Blackmores’ has increased its full-year profit by more than half, achieving $93.7 million in revenue after improving direct sales to China. In-country sales to China rose by 6.1% from 2021 to 2022.

Contact us to sell your health supplements products in China

To successfully enter and conquer the vitamin and health supplement market in China, it is imperative to have a clear market development strategy and roadmap. Gentlemen Marketing Agency is a team of experts who specialize in helping brands market their health supplements in China and enhance their online presence.

With our in-depth case studies and understanding of the lucrative opportunities in the nutrition, vitamin, and health supplement markets, we can guide you toward increased sales. By leveraging the growing demand for Western brands and implementing effective marketing tactics, you can capitalize on this thriving market. Our agency’s local expertise ensures that you navigate the challenges and pitfalls of the Chinese market.

We are Tmall Partner, JD partner, Douyin Partner and have connexion with health products distributors

We excel in search engine optimization (SEO) on Baidu, China’s leading search engine, and employ digital tools such as Baidu SEO, SEM, E-PR, Media Buying (DSP), and Community Management to enhance your brand’s online visibility and reputation.

As an ROI-focused agency, we ensure cost-effectiveness while delivering results. With extensive experience working with over 300 Western brands, we have the knowledge and expertise to drive success in the Chinese market.

Moreover, we specialize in lead generation, employing strategies such as data analysis, online advertising, and creating high-quality content to develop your brand’s e-reputation and attract a substantial consumer base.

If you are seeking guidance on marketing your health supplements brand in China, we encourage you to contact us. Our team will respond promptly within 24 hours to provide the assistance and support you need.

10 comments

Eran Shani

Hello.

We are a producer of microalgae in a new highly controlled environment in Iceland. Among the outcomes of this unique technology, we offer Algal Omega 3 with polar lipids for efficient cellular absorption from a microalga called Nanno Chloropsis. We also offer Spirulina, exceptionally rich in natural and active vitamin B12. If you wish to add Spirulina powder to your products, a small amount of 0.15gr per serving is enough to cover RDA and allow an EFSA/ FDA Health claim.

Our products are available as finished goods or as ingredients.

On top of that, as we are a carbon-negative company, using our Spirulina entitles the producer of the plant-based product to use a logo, indicating how many tons of CO2 you can offset. Kindly contact us so we can share more information.

Thank you

Olivier VEROT

Sure we will contact you. It sounds a very innovative product

Lester Chan

Hi,

Could you contact me back through email will like to get to know more about your comany’s services, we are a precision wellness brand in Singapore looking to enter the Chinese market.

Lester Chan

CEO

Iga

Hello Lester,

Thank you for your message, we will send you an email ASAP.

Mojtaba

Thanks, very informative.

Jin Wang

It is really a great article. In China and online, nutrient supplements are regulated as one category under the umbrella term health food. A full testing report is necessay in China to sell health supplements.

Testing of three samples batches is also required for filing of health supplements, (hygiene test, stability test, and effective ingredients or iconic composition test.)

maeyi

i’m an agent selling a weight loss product. would want to market to china . i’m from malaysia

Olivier VEROT

Contact us and explain to us your project and brands you work for. 🙂

Mr Migdad Al-fadil

Hi china agencies, Our products of nutritional supplements help children grow Extremely powerful against viruses are available now in South Korean market . We would like to contract with an exclusive agent in China who buys from us and sells in China our product name DOULAC

For those interested send me your company profile and contact me on WhatsApp, we do not finance, we just want to sell in the Chinese market through authorized and exclusive agents

Best regards

Migdad Al-fadil

Mob&WhatsApp

+923211234544

Olivier VEROT

we will reply to you by email.

We are a marketing agency and can help you to find agent if you are a good brand.